This is part one of a three part series on how the NBA’s decision making since 2002 has contributed to it’s shaky ratings and precarious Regional Sports Network situation. In part one we discuss the NBA’s weird place in the post-Michael Jordan era and how a push to be the first league who was all in on cable might have been the original sin.

* * * *

The Wilderness

The post Michael Jordan era was a tough one for the NBA.

Prior to Michael Jordan officially announcing his retirement there was a prolonged and brutal lockout which saw the league losing 32 games of it’s 1998-99 schedule. Things got personal. Reputations became scarred. The league was seeking to reign in ballooning rookie/young player contracts and to reduce the players percentage of the BRI (Basketball Related Income) in order to put individual salary caps on player deals. To achieve this the NBA locked out the players in a signal-sending a we mean it sort of way. The NBA, indeed, got most of what it was looking for but the lockout lasted half a year.

The post-lockout league emerged incredibly damaged and in its weakened state came the double whammy of the long-expected Michael Jordan second retirement in January of 1999 (documented in the Netflix’ The Last Dance program). After a brief ratings bump in that lockout shortened year (likely down to curiosity and less games) the league saw a a definite small ratings decline for the Shaquille O’Neal/Kobe Bryant Los Angeles Lakers three-peat. The NBA was missing it’s biggest-ever star. All of these games were broadcast on it’s 1990’s TV partner NBC.

It’s hard to put adequately into words the sheer force of nature Michael Jordan was. He was the right player, with the right personality and the right marketing savvy that you can’t easily replicate (for the NBA in the last 25 years it’s proven to be impossible). Jordan was the most recognized player on the planet and was utterly dominant on the court. The NBA saw a TV ratings explosion from Chicago Bulls first title in 1991, managed to survive his first retirement in 1993 and thrive even more when he returned in 1995. It is safe to say that losing someone like that — for the a league that farms out much of its marketing to individual players — was a gigantic blow for the league. Jordan is Jordan.

The post-lockout league was a combination of rapidly aging/done 90’s superstars (Patrick Ewing, Hakeem Olajuwon, David Robinson, Charles Barkley, Scottie Pippen) a new superstar who wasn’t without controversy (Allen Iverson), a superstar who had no magnetic personality and was in a small market (Tim Duncan) and one Lakers dynasty featuring Shaq and Kobe. None of whom proved to be the once in a lifetime sheer force of nature that Jordan was. You add in a clunky, physical style of play with low scoring games and you get the Wilderness years of the league.

Yet, we cannot underestimate the impact of a decision made in 2002 that changed the viewership trajectory of the league. A bet that they were ahead of the curve might have been the reason it curved against them.

A bet on cable

Regional Sports Networks (hereafter referred to as RSN’s) became sort of fashionable by the late 1980’s in response to the growing popularity of ESPN (which began ib 1979). These were networks that would broadcast local teams to regional markets that you’d pay a small cable fee to access. Most Denver Nuggets fans over the age of 43 likely remember old Prime Sports Network which carried Nuggets home games, while Nuggets road games were carried on over the air on Channel 2. This arrangement persisted until the late 1990’s when RSN’s became more dominant and therefore began carrying all games at the expense of over the air TV. Prime Sports was absorbed by the Fox Sports Network and the Nuggets were broadcast on Fox Sports Rocky Mountain.

RSN’s were all the rage … as long as they were affordable.

Disney had acquired ABC and ESPN in 1995 during the reign of Michael Eisner. This was part of Eisner’s larger gambit to expand Disney’s corporate portfolio beyond amusement parks and mild escapist children’s fantasy films and animated movies. Immediately, Disney/ESPN began to court the NBA. Riding high on Jordan’s return to basketball in 1995 culminating in his third championship in a row (sixth overall) in 1997-98 the NBA wasn’t inclined to take ESPN up on it’s push. The NBA re-upped in 1997 (beginning in 1998) with NBC for four years at just under $2 billion. This proved to be the last deal that the league would sign a deal with a primarily over the air media conglomerate. Ratings had declined by almost a third in the post Jordan era and the league was looking to shake things up.

Meanwhile RSN’s were popping up all over the country in various iterations. Teams were signing individual TV rights deals with these networks while in turn these networks were charging carriers (your local cable provider) a fee for the right to carry them over cable/satellite. There was what the league was looking at on a national scale, and what individual teams HAD been doing since the 90’s. Cable seemed to be not only the wave of the future but the wave of the present.

Disney/ESPN set its sights on 2002. Their ultimate success in securing a media package (along with Turner) proved to be, in the long run, an almost Pyrrhic victory for the NBA.

All in with ESPN

The NBA signed a $4.6 billion TV broadcast package with Disney/ESPN and Turner in January of 2002. In the agreement Turner agreed to partner with the NBA on a exclusive NBA cable TV station (NBA TV). By far the largest and most expansive package in their history. In a shocking move, the ESPN limited their ‘over the air’ games on ABC to 15 regular season games while agreeing to broadcast up to 75 games on the cable network ESPN. To put this in perspective, NBC through it’s double and triple header days would broadcast around 33 a year exclusively over the air.

While this gave the league a large amount of money for broadcast rights it might have boxed them in to the whims of their cable model. Essentially becoming a slave to the good (or bad) fortunes of ESPN.

Going all in with Disney ESPN and Turner as the NBA did starting in 2002 left them with a bit of a quandary. Unlike the NFL which isn’t dependent on one or two networks and broadcasts most of 90% of it’s games over the air (The NFL has separate deals with every over the air network, ESPN and a streaming deal with Amazon plus their own dedicated network) the NBA sort of disappeared from sight, something that they must have predicted would happen. Ratings dropped precipitously and truly have not recovered to the Jordan era 90’s highs aside from the early two “Lebron in Miami” years.

The NBA, effectively, flipped the NFL model and had most of its National TV games broadcast on cable, and a very tiny percentage over the air. Something that had never been done before.

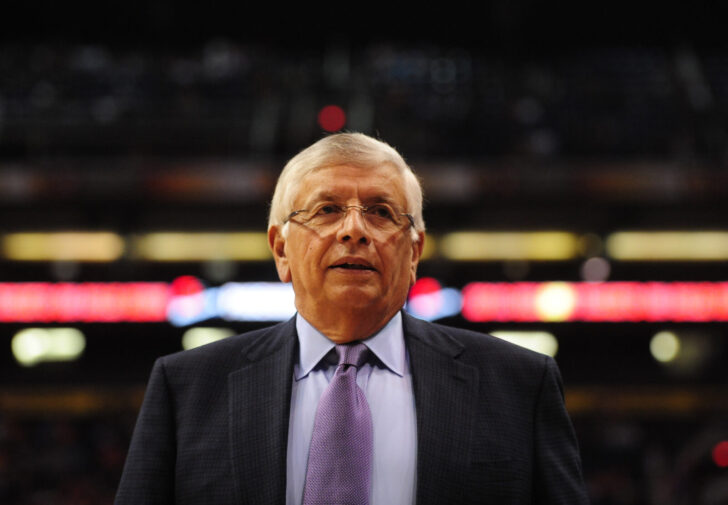

Former NBA Commissioner David Stern was a large proponent of being ahead of the curve when it comes to sports media trends. Seeing things before they become a really popular, rather than waiting for the crest of the wave. This is good business thinking. Yet, with the ultimate in hindsight, the NBA might have been too clever by a half (as the British would say) and boxed itself in to a form of viewership that was to become diffuse, and centered around how much people were willing to pay for cable to see these games. It was a gamble.

ESPN’s Financial Issues

Now, it’s fair to say the league could not have foreseen the great RSN collapse of the last 5 years or so. Nor could they have foreseen the gigantic ratings and financial issues that ESPN would face starting in around 2014-15 that led to the network going fully into hot take shows and provocateurs rather than analysis. Somewhat ironically this coincides with the renewal of ESPN’s media deal with the NBA. Could the league have forseen when they renewed with ESPN that cord cutting would become this prevalent? Were they burying their head in the sand about ESPN’s issues?

It is safe to say, on the other hand, that the NBA tying itself the last 22 years to ESPN was a choice and diversity of TV packages ala The NFL could have been something they chose to do even all the way back in 2008, then again in 2014. The NBA made a deliberate choice to limit its over the air presence by signing multiple media deals with Disney and Turner.

As ESPN has become more and more hot take based the last decade the quality of coverage of the sport that is most closely dependent on the cable network has declined. Analysis has been subsumed into a perverse form of ratings dependent coverage. (Ratings are largely reliant on large/costal markets who ‘move the needle’ in terms of interest.)

None of this has moved the needle, the league has averaged around 1.6 million viewers for a very long time now and ESPN’s devolution into hot takery hasn’t helped.

The NBA could have avoided this problem by following the NFL model of over the air saturation with multiple media companies and not putting the majority of their eggs in one basket. Now, as the NBA is in the midst of negotiations for a brand new media package there has been speculation that NBC (Comcast) is looking to get back in the mix to broadcast national NBA games. As well as some large streaming platforms such as Apple and Amazon. What will the league media deal will look like in 2025 will fundamentally shape the way we consume basketball.

The RSN Problem

This does NOT fix the RSN problem. NBA teams are struggling to find ways to reach fans and also monetize their rights as RSN’s all over the country have collapsed. As we know all too well here in Denver when these disputes go south it can take many years for them to resolve.

One of the giant advantages the NFL has over all the other sports leagues comes down to less games. Simply put while the other major sports leagues have an 82-162 regular season game baseline the NFL only has 17. This gives it a strategic advantage to have all of their games broadcast nationally as opposed to locally. The NFL’s ability to be national is wholly dependent on the limit to their schedule, which other leagues simply can’t compete with (along with the obvious in-stadium size advantage as well).

The NFL is carried almost exclusively over the air (with exception of ESPN Monday night football games and Amazon Thursday Night). You KNOW where they are going to be every game. You know every game is nationally broadcast. They are the only league who can pull this off because, as I said, 17 games.

The main carriage providers in the country (DirecTV, Comcast, Dish) have made the ability to carry RSN’s on their services much more difficult. Squeezing these channels for all they can. Subsequently we’ve seen multiple go out of business (AT&T Sportsnet, Bally’s etc…). A few number of NBA teams have taken their games directly to over the air networks in their local markets (Utah Jazz local, Phoenix Suns local) and this will be closely monitored. This more closely resembles the model that was used in the 80’s and most of the 90’s. Easily accessible games broadcast over the air. Could this potentially point the way to a new/old model? We shall see.

Diversity of broadcast/streaming associations can bring back some prominence and place the league back in the consciousness of the public. Having your games easily accessible can also rebuild prominence in local markets. None of this is easy but in 2002 the league made a big decision to go all in on cable. That sort of sea change might be what the league needs now.

* * * *

Part two of this series coming soon. How the mid-2000’s push from the NBA to be a big player in markets where they were the only show in town contributed to the mess it is in right now.